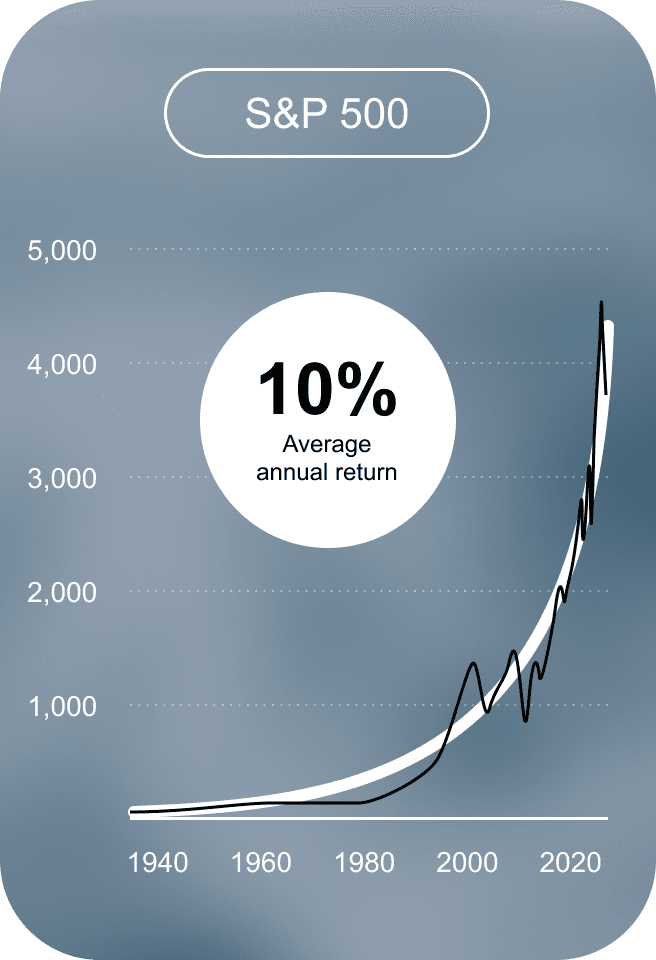

Proven long-term investment strategy

Rather than trying to time the market or guess which stocks are going to win big, investing early, often, and consistently with a portfolio of index funds is a tried and true investment strategy.

The S&P 500 is an index that lists 500 of the largest companies in the United States. Though the S&P 500 has observed several declines in its history, it has always bounced back, bigger and better than before. Even legendary investor Warren Buffet recommends it. In fact, less than 10% of professional money managers beat the S&P 500 over the long run.

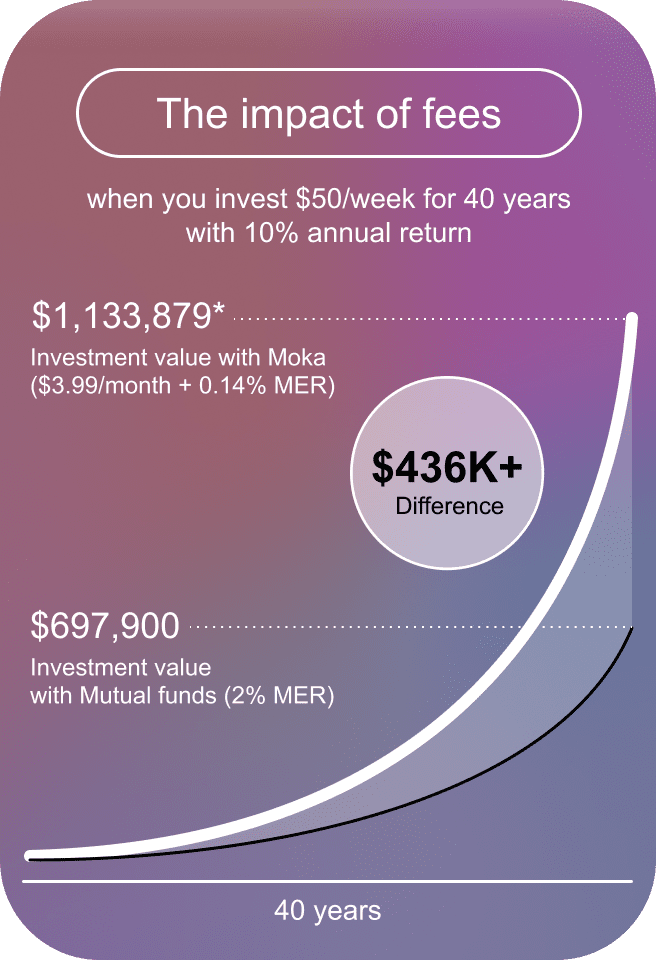

Fees matter, a lot

When you're investing for your future, fees matter a lot. Many mutual funds charge 2% fees, and many financial advisors charge a 1% fee. This may not sound like much, but a long time horizon means that percentage fees will compound and undercut your returns by a lot.

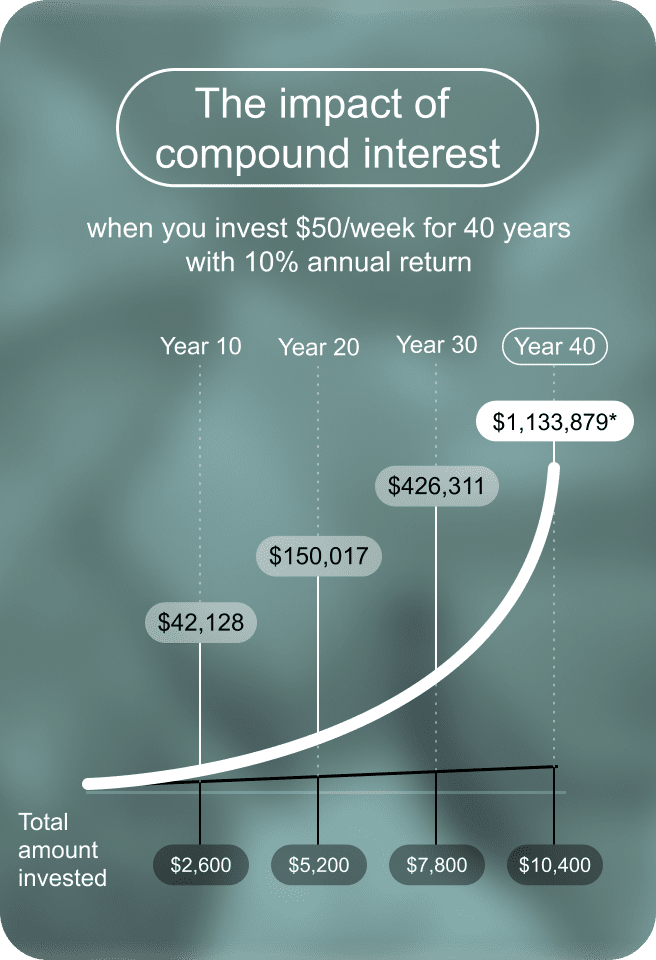

Compound interest is the eighth wonder of the world

The power of compound interest shows how you can really put your money to work and how the long time horizon can get you rich. When you earn interest on your investment, that interest then earns interest on itself and this amount is compounded.

$1.2M net worth would put you in the top 1% in the world

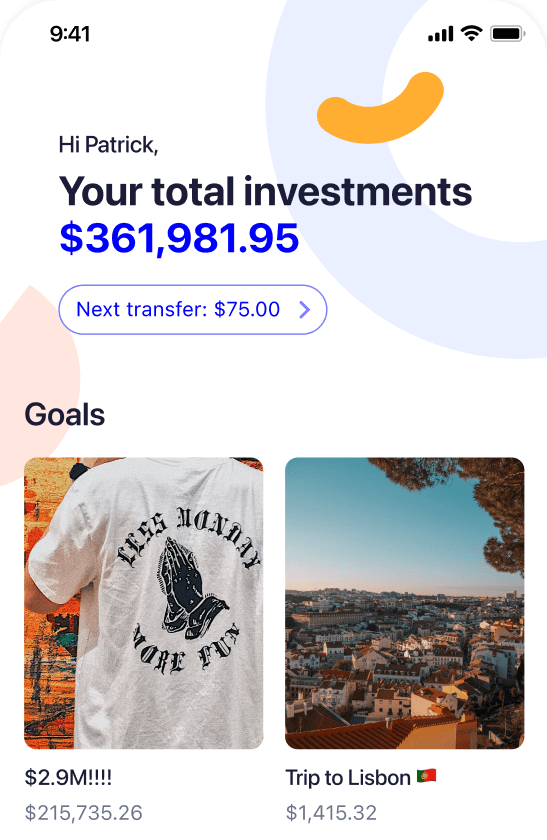

Know you're becoming a millionaire while crushing your other money goals

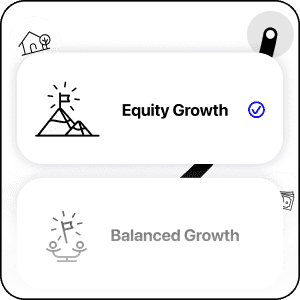

Personalized investments managed by pros

Everyone has different financial goals. Whether you're investing over a long time horizon towards a goal like financial freedom, or over the short term for a goal like your very first down payment on a home, your experienced portfolio manager will select the perfect portfolio for you and manage your investments every step of the way.

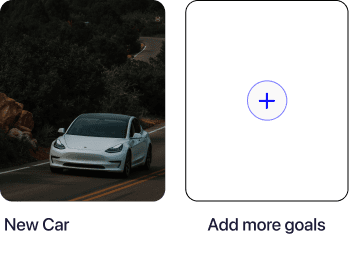

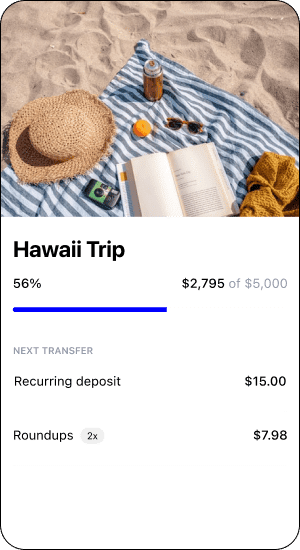

Got tons of goals? Don't sweat it.

Want to go on a vacation? Don't just put it on credit and wind up in debt. Moka makes it easy to save up for the things you want, fast.

Alongside your long-term wealth-building journey, you can set up as many savings goals as you'd like with no additional fees. Moka's short-term portfolios are more protected from market volatility, helping you grow your money with less risk.

A typical savings account offers just 1% interest on your money. Moka's savings portfolios see average returns of 2.83% on terms of one year or less, earning you almost double the return.

Invest with impact

When you invest with Moka, you join Mogo's 1.8+ million members in using your money for good, and creating positive social impact just by building personal wealth. You can amplify your impact by choosing Moka's Socially Responsible Investment Fund, which invests in companies dedicated to making the world better for all.

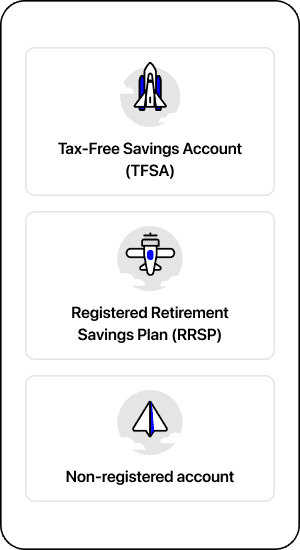

Accounts that fit your goals

TSFA

A Tax Free Savings Account lets you build wealth tax free on the gains that you earn over time.

RRSP

A Registered Retirement Savings Plan lets you defer and decrease your taxes for when you retire.

Non-registered account

A Non-registred personal investment account is a taxable account where you can continue to invest after maxing out your RRSP and TFSA accounts.

With Mogo, you can build wealth and make the world a better place just by doing your daily spending and investing. Moka, powered by Mogo, is our simple and powerful solution to help you invest early and consistently. This is the revolution. And we're just getting started.

Peace of mind, at all times

Access your money any time

With Moka, you're never locked in. You can withdraw your money at any time, for free.

Talk to a human, any time

Got questions about your money? We can help. Reach out to speak with one of Moka's (human!) portfolio managers whenever you need.

Your money is safe

Your RRSP and TFSA investment accounts have CIPF coverage which covers up to $1M for all general accounts combined (including TFSAs) and an additional $1M for registered retirement accounts (like RRSPs).